Safe Payment

Protect your capital during high-stakes trade. We provide a fully digital escrow infrastructure designed specifically for cross-border transactions of high-value assets exceeding $10,000.

Safe Payment

Protect your capital during high-stakes trade. We provide a fully digital escrow infrastructure designed specifically for cross-border transactions of high-value assets exceeding $10,000.

Swiss-Secured Digital Escrow

Experience the future of high-value trade. We replace slow, expensive banking procedures with a fully digital, compliant escrow solution—guaranteeing 100% insolvency protection under Swiss law.

Swiss Insolvency Protection

Maximize your security. Your funds are legally shielded by unique Swiss Escrow Law [Art. 47 FINMA], ensuring absolute protection against both agent and bank insolvency—a safeguard unavailable in many other jurisdictions.

Cost Efficiency

Stop overpaying for security. Traditional bank escrow services often charge up to 8% of the total transaction value. Our digital-first infrastructure significantly reduces overhead, keeping your costs low and margins high.

High-Value Transactions

Transact without limits. While standard payment processors (like PayPal) cap amounts, we enable carefree, worldwide transfers for goods and assets exceeding $10,000.

Rapid Settlement

Close deals in minutes, not months. Traditional bank escrow often involves 2–6 weeks of paperwork. Our fully digital solution accelerates your workflow, allowing you to move at the speed of modern business.

Seamless Integration

Integrate directly into your existing platforms. We offer fully digital onboarding and e-signing capabilities that merge effortlessly into your negotiation and trade processes.

Swiss Insolvency Protection

Maximize your security. Your funds are legally shielded by unique Swiss Escrow Law [Art. 47 FINMA], ensuring absolute protection against both agent and bank insolvency—a safeguard unavailable in many other jurisdictions.

Cost Efficiency

Stop overpaying for security. Traditional bank escrow services often charge up to 8% of the total transaction value. Our digital-first infrastructure significantly reduces overhead, keeping your costs low and margins high.

High-Value Transactions

Transact without limits. While standard payment processors (like PayPal) cap amounts, we enable carefree, worldwide transfers for goods and assets exceeding $10,000.

Rapid Settlement

Close deals in minutes, not months. Traditional bank escrow often involves 2–6 weeks of paperwork. Our fully digital solution accelerates your workflow, allowing you to move at the speed of modern business.

Seamless Integration

Integrate directly into your existing platforms. We offer fully digital onboarding and e-signing capabilities that merge effortlessly into your negotiation and trade processes.

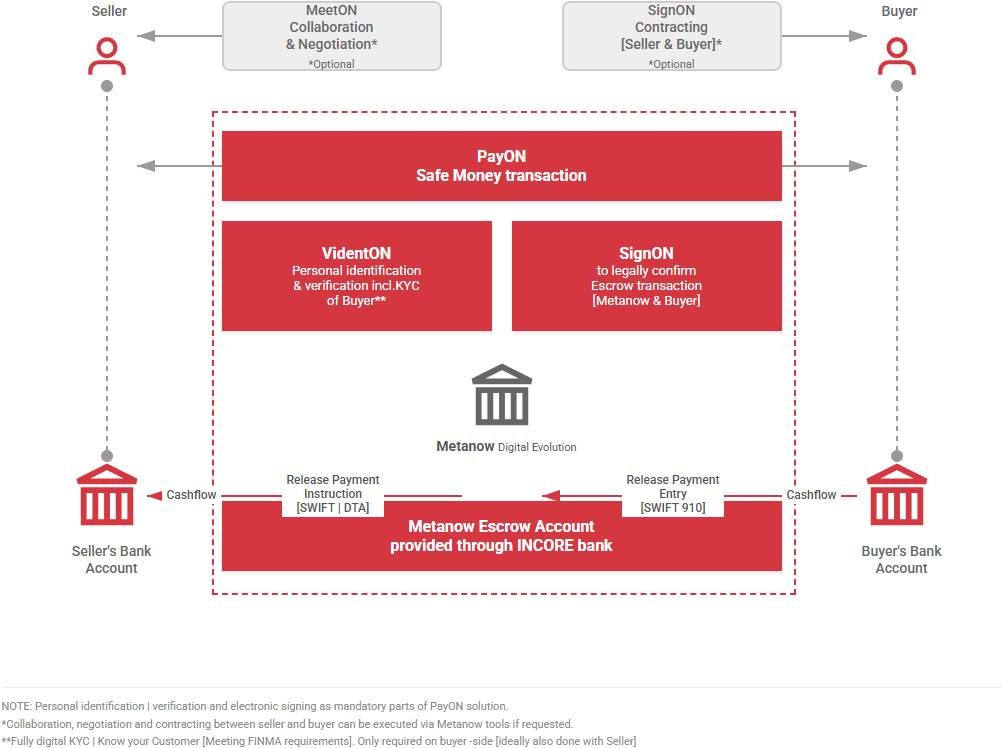

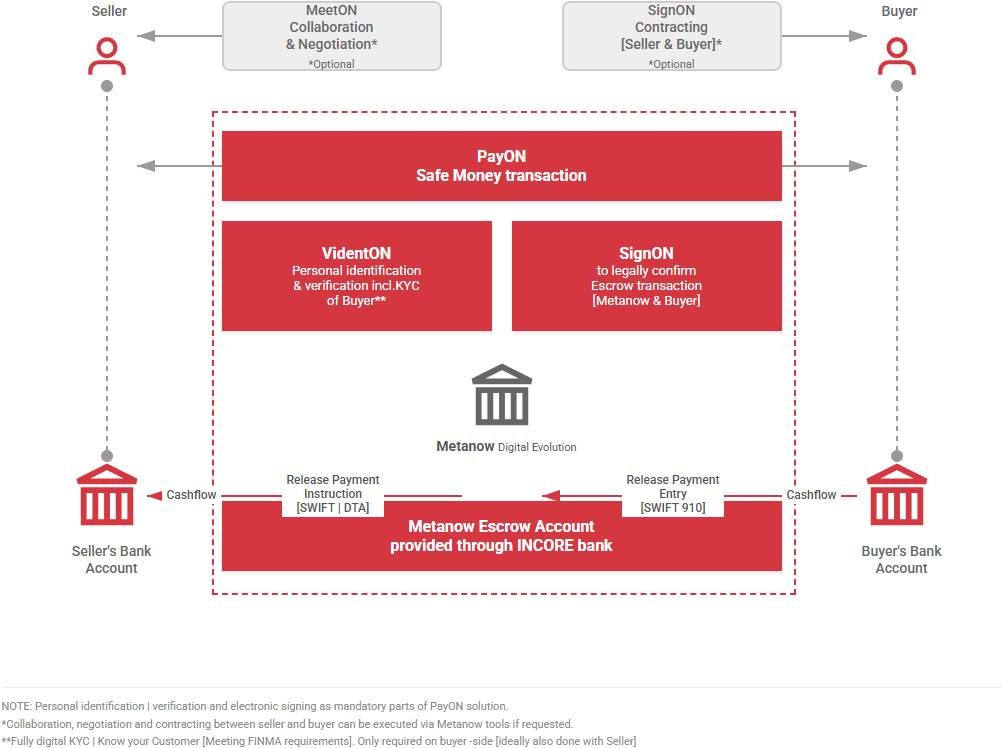

PayON: Frictionless Global Trade

Secure your high-value transactions with PayON. Our fully digital escrow solution ensures compliant, fraud-free, and cost-effective trade for goods exceeding $10,000—integrating ID verification, e-signatures, and real-time tracking.

High-Value Digital Escrow

PayON is our premier solution for fully digital transactions of goods exceeding $10,000. We enable frictionless global trade relations while actively reducing fraud through a compliant, cost-effective, and fast escrow service.

Our platform ensures a seamless end-to-end experience, covering critical functions:

- Customer Identification & Verification

- Qualified Electronic Signature (QES)

- Secure Video Collaboration

- Contract Management

- Real-time Tracking (Payment | Goods)

High-Value Digital Escrow

PayON is our premier solution for fully digital transactions of goods exceeding $10,000. We enable frictionless global trade relations while actively reducing fraud through a compliant, cost-effective, and fast escrow service.

Our platform ensures a seamless end-to-end experience, covering critical functions:

- Customer Identification & Verification

- Qualified Electronic Signature (QES)

- Secure Video Collaboration

- Contract Management

- Real-time Tracking (Payment | Goods)

Why Choose Metanow?

We combine the speed of digital fintech with the security of Swiss banking standards. From rapid onboarding to legally binding signatures, our platform offers a superior alternative to traditional escrow processes.

Speed & User Experience

Complete transactions in minutes vs. weeks compared to traditional bank escrow processes.

Significantly more cost-effective than traditional escrow fees, with fewer delays and reduced complexity.

No physical presence needed. Collaborate via secure video stream for a superior customer journey.

Seamless White-Label integration directly into your app, website, or POS infrastructure.

Compliance & Protection

Unique insolvency protection for agent and bank under Art. 47 of the FINMA Banking Insolvency Ordinance.

Instant background checks (Buyer/Seller), credit checks, and verification active fraud prevention.

Qualified Electronic Signature (QES): Legally equivalent to a handwritten signature (ZertES Swiss Signature Act).

Secure, compliant storage of all transaction data, including audio, video, and document history.

Speed & User Experience

Complete transactions in minutes vs. weeks compared to traditional bank escrow processes.

Significantly more cost-effective than traditional escrow fees, with fewer delays and reduced complexity.

No physical presence needed. Collaborate via secure video stream for a superior customer journey.

Seamless White-Label integration directly into your app, website, or POS infrastructure.

Compliance & Protection

Unique insolvency protection for agent and bank under Art. 47 of the FINMA Banking Insolvency Ordinance.

Instant background checks (Buyer/Seller), credit checks, and verification active fraud prevention.

Qualified Electronic Signature (QES): Legally equivalent to a handwritten signature (ZertES Swiss Signature Act).

Secure, compliant storage of all transaction data, including audio, video, and document history.

Frequently Asked Questions

What is Metanow?

Metanow is a digital escrow platform that secures high-value trade. We combine video identification, electronic signatures, and automated payments into one seamless flow, ensuring trust between buyers and sellers worldwide.

Who is this solution for?

Our services are designed for businesses engaging in high-stakes B2B trade, international exporters, and marketplaces that require secure financial settlement for assets or goods exceeding $10,000.

What is the minimum transaction volume?

Our solution (PayON) is optimized for high-value commerce. We facilitate transactions starting from $10,000, providing a cost-effective and faster alternative to traditional Letters of Credit.

Is my money safe in case of insolvency?

Yes. You benefit from Swiss banking standards. Funds are held in segregated accounts protected by Art. 47 of the FINMA Banking Insolvency Ordinance, securing your capital against both agent and bank insolvency.

How fast is the process compared to banks?

While traditional bank escrow can take 2-6 weeks of paperwork, Metanow allows you to onboard, sign, and initiate settlement in minutes via our fully digital platform.

Does Metanow handle the shipping logistics?

No. We focus purely on financial security and compliance. However, our payment release triggers are tied to your logistics milestones (e.g., proof of delivery), ensuring funds are only released when the goods arrive.

How does the identity verification work?

We use advanced video identification technology. Users simply click a link to start a secure video session where their ID documents and liveness are verified in real-time, preventing fraud instantly.

Are the digital signatures legally binding?

Yes. We utilize Qualified Electronic Signatures (QES) which are legally equivalent to handwritten signatures under the Swiss ZertES and European eIDAS regulations.

Can I integrate Metanow into my own website?

Absolutely. We offer a "White-Label" solution via RESTful APIs, allowing you to embed our full onboarding, verification, and payment flows directly into your own app or website branding.

Where is my data hosted?

Data sovereignty is paramount. All sensitive transaction data and documentation are securely hosted on Swiss servers, ensuring compliance with strict data privacy laws.

What is Metanow?

Metanow is a digital escrow platform that secures high-value trade. We combine video identification, electronic signatures, and automated payments into one seamless flow, ensuring trust between buyers and sellers worldwide.

Who is this solution for?

Our services are designed for businesses engaging in high-stakes B2B trade, international exporters, and marketplaces that require secure financial settlement for assets or goods exceeding $10,000.

What is the minimum transaction volume?

Our solution (PayON) is optimized for high-value commerce. We facilitate transactions starting from $10,000, providing a cost-effective and faster alternative to traditional Letters of Credit.

Is my money safe in case of insolvency?

Yes. You benefit from Swiss banking standards. Funds are held in segregated accounts protected by Art. 47 of the FINMA Banking Insolvency Ordinance, securing your capital against both agent and bank insolvency.

How fast is the process compared to banks?

While traditional bank escrow can take 2-6 weeks of paperwork, Metanow allows you to onboard, sign, and initiate settlement in minutes via our fully digital platform.

Does Metanow handle the shipping logistics?

No. We focus purely on financial security and compliance. However, our payment release triggers are tied to your logistics milestones (e.g., proof of delivery), ensuring funds are only released when the goods arrive.

How does the identity verification work?

We use advanced video identification technology. Users simply click a link to start a secure video session where their ID documents and liveness are verified in real-time, preventing fraud instantly.

Are the digital signatures legally binding?

Yes. We utilize Qualified Electronic Signatures (QES) which are legally equivalent to handwritten signatures under the Swiss ZertES and European eIDAS regulations.

Can I integrate Metanow into my own website?

Absolutely. We offer a "White-Label" solution via RESTful APIs, allowing you to embed our full onboarding, verification, and payment flows directly into your own app or website branding.

Where is my data hosted?

Data sovereignty is paramount. All sensitive transaction data and documentation are securely hosted on Swiss servers, ensuring compliance with strict data privacy laws.

Do you have any questions or concearns?

We are available and happy to advise you personally. Our team of experts will get back to you quickly and reliably.

Prefer a call?

Book a short discovery call, and we'll explore how we can help you move forward with clarity and structure.